Leviathan Is Less Lindy

Ft. Jim Grant, Hugh Hendry, Caitlin Long, Chamath Palihapitiya & Nathan Tankus

Leviathan: Giant beast. Also a book by Thomas Hobbes. On the his book:

Written during the English Civil War (1642–1651), Leviathan argues for a social contract and rule by an absolute sovereign. Hobbes wrote that civil war and the brute situation of a state of nature ("the war of all against all") could only be avoided by strong, undivided government.

Lexicographers in the early modern period believed that the term "leviathan" was associated with the Hebrew words lavah, meaning "to couple, connect, or join", and thannin, meaning "a serpent or dragon".

In the Westminster Assembly's annotations on the Bible, the interpreters believed that the creature was named using these root words “because by his bignesse he seemes not one single creature, but a coupling of divers together; or because his scales are closed, or straitly compacted together.”

Samuel Mintz suggests that these connotations lend themselves to Hobbes's understanding of political force since both "Leviathan and Hobbes's sovereign are unities compacted out of separate individuals; they are omnipotent; they cannot be destroyed or divided; they inspire fear in men; they do not make pacts with men; theirs is the dominion of power."

Leviathan is the world’s various financial systems “compacted together” into a beast.

The Leviathan of our global economy looks less “lindy” every day.

For most of history of global finance, economic and societal problems were localized, and while some countries and empires failed others survive, some industries and assets went up while others declined - some zigged as others zagged. Over time, however, the world became interconnected in every way - “wreathed, twisted in folds” - so that problems in one place can easily become problems for all.

Now there’s a rush to liquidate and raise cash. Zig = Zag. Correlation approached 1.

Liquidity is lacking - and what worked a decade ago during the last crisis won’t now.

And Mr. Market apparently hasn’t learned anything since the great financial crisis.

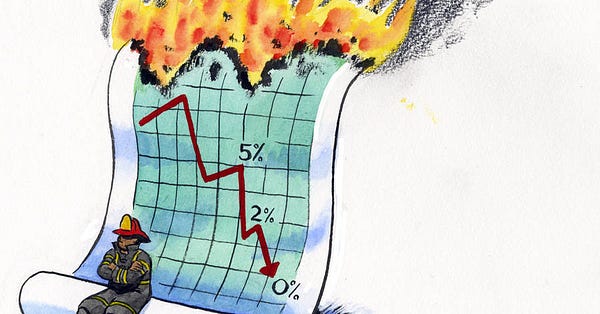

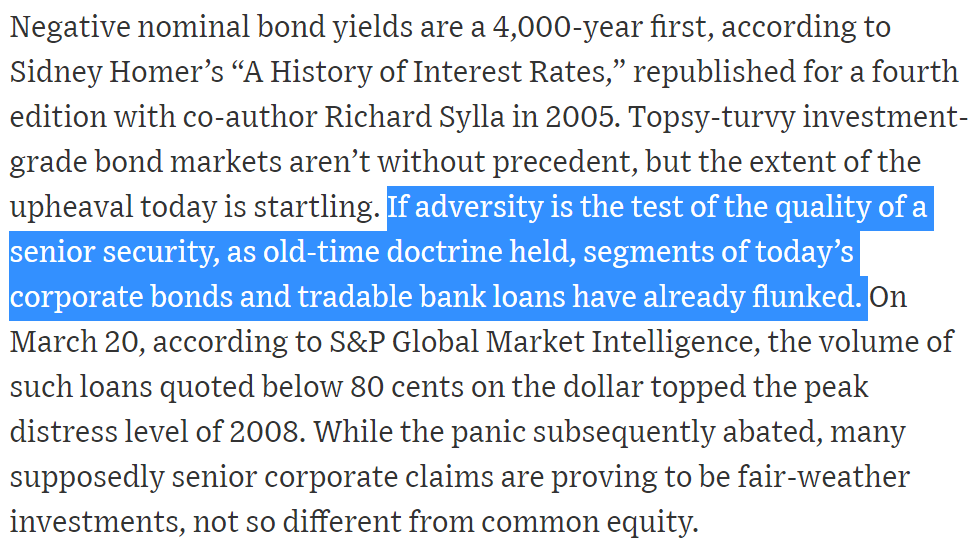

from Jim Grant:

And where is credit now in terms of the big picture? Not in a good place.

From Grant:

How did we end up here? The powers that be arm-twisted Mr. Market for a short game: the propping up of entire industries and balance sheets - held captive by a managerial class focused on quarterly games (including debt fueled value extraction).

It was all done by driving rates flatter than panes of sugar glass - sweet, brittle, fragile, whisper thin, offering brief sugar rushes - leaving Mr. Market ever hungrier for more.

Grant cautions readers that the ultimate cost is not just misallocated capital.

Another independent mind is Hugh Hendry, known for almost two decades, for his Eclectica hedge fund and his appropriately eclectic thoughts. He was the gadfly who embraced speaking truth to stupid and it came at great cost. I don’t refer to his fund closing but to the common human pursuit of joy and passion. Fortunately, he’s back.

Late of the property development business in St. Barts with a 10% annual target, Mr. Hendry comes in from the cold, with new thoughts both electric and eclectic.

In an interview with Grant Williams, formerly of Real Vision, Hendry delivers insight.

Hendry sees a potential for inflation but it would have to be catalyzed by “really really bad things happening” - and here we are. He cautioned however to keep in mind about Japan’s post-1980s bubble burst experience, with public debt at “220 percent of GDP” and is still not being experiencing “Weimar” (i.e. Germany’s 1920s) hyperinflation.

Thinking about the potential size of the monetary and fiscal measures which could be taken to restart a halted global economy led Hendry to revisit gold - which was part of his first big trade for Eclectica. After a near-decade long reset gold may again become a long risk asset to be “overweighted”. He’s sanguine about bitcoin - If asked if it “would that be something you would be interested in?” he would demur.

Moving on to another independent thinker - Caitlin Long, of Wyoming and the future of money, is now building a bank. Ms. Long put it plainly, that the world’s struggle with the virus has been a catalyst for a crisis some have been waiting for with some dread - a credit crisis of the entire financial system:

“The virus is just the pin that breaks the bubble, the credit-bubble is by far the bigger issue”

Thinking about Hendry and gold, Long reminded us that gold is one of those assets free of being shackled to an offsetting liability and is therefore not an “I.O.U.” (e.g. you have cash on hand, which was borrowed, therefore you have cash but you owe a loan).

Long focused on one characteristic of the past decade’s contender to gold, bitcoin:

“I really don’t care about the price of Bitcoin, I care about one thing and one thing only: is the network working, is it stable? And you know what, the network stability is stunning in the face of all the volatility and volume increases”

The problem for even safe haven assets is that we have been in a big liquidation, which caused everything that could be sold off to be sold and pushing prices lower.

Her interview with “Pomp” (also documented by a great site, Podcast Notes) is a must.

Let’s set the big talk aside. Here is one tragic part of life in the “gig economy” - those who need it most may get it least and last - another ingredient for more societal stress.

These labor costs were socialized in effect. “On Demand” PE and Unicorn investors have been subsidized by a NIRP/ZIRP world’s financial order. There’s nothing private about these startups when it comes to real labor cost inputs.

A great observer and writer Nathan Tankus covers this space so ably.

Tankus observed that while a few months ago recession wasn’t in the cards, it is now because we failed yet again to make the system more robust and more anti-fragile.

"This system isn't fragile because of "bubbles" or any exorbitant spending or "trickle down", it's fragile because we haven't designed systems to respond to crises. we could have not had any of those things and we'd still be vulnerable to this crisis.”

"The immorality is that we don’t have this infrastructure and people have already died because of it. Our failure to help everyone is a far greater sin than some people disproportionately benefiting.”

Before you think this was seeded with a lineup of “bearish” people, another “must read / listen” is Chamath Palihapitiya’s talk with “Pomp”.

Palihapitiya is a venture capitalist and billionaire who, like Ms. Long, saw the safe refuge optionality of bitcoin and bought when it was in the 80s. He also sees that this is not the time necessarily for investment risks - that it’s instead a time for learning.

This is not a time for day-traders. The greater opportunity is that clarity from patience and learning could yield “ten bagger” magnitude investments. Hold cash for that.

And he sees a greater overhang at the municipal level that runs into the trillions which truly should be the focus on fiscal bailout policy. Pensions may be at the heart of this.

Palihapitiya’s way forward and out of a greater crisis brought on by the shutdown:

“We are going to need a massive stimulus package that incentivizes building things, creating things, repatriating supply chain back to the US, and in that I think there is a way out of this”

(Addressing this crisis at the local level, Nathan Tankus, who also calculated that the sum ran at four commas, suggested a solution involving the creation of “local” money, similar to what was done in the 1930 for bleeding in local and state-level finances.)

My gut reaction is that if we’re going to bail out any security class, then go for the senior claims. They become the new equity. At the same time, Mutualize and give the policy holders and depositors shares. Say goodbye to stock options for the pilots who pushed the throttle with the tanks on vapor but made sure they alone had parachutes. In the end you are helping shareholders, they don’t know it yet because they’re the creditors.

Let the healthy do the work - those able to repair, rebuild and restore for the long game as opposed to gaming for perverse quarterly and regulatory incentives.

But that’s not going to happen at all is it?

We’re going to do it the hard way by doing what is expedient for a relative few at the expense of many. We’re going to replay a game of helping those who can play the game of getting “help” in the financial markets. The big get bigger, the sharp elbowed get to the front of the line, and the short game runs until it’s played out wiping out the board.

These notes will be revisited and revised - I’m riffing and ranting my way to asking new questions - the answers are secondary and subject to change with new facts.