This is a submission, intended the Soaring Twenties Social Club’s Symposium, a collaboration amongst writers of the STSC, inspired by a monthly theme of “Home”.

Click your heels three times.

Lead your boats forward, far from the beaches you landed on to topple the storied walls of a mighty city, and face an endless series of monsters, back to your wife.

Run the gauntlet with a band of brothers, so that you might retrieve and return the last son of a woman who gave all her boys in service to turn the tide of the Axis.

Be brought back on your shield if you do not stop Xerxes and his legions of demons.

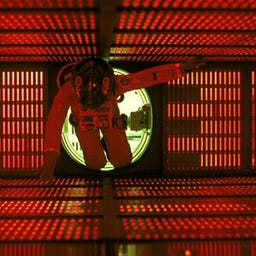

Weigh anchor and hurl through the stars a battleship from an earlier time, refitted for a battle against all odds, to save a dying world, and come back hopefully.

A basket on the water, and then one day, parting mighty waters, to save your people.

Begin a revolution, flee in retreat, on a “Long March”, to takeover where you began.

A rocket launched last minute, before the end, sent far away, to begin all over again, faster than a speeding bullet, more powerful than a locomotive, and able to leap tall buildings, to keep safe a precious replacement for what you lost after you were born.

Go with your best friends to get rid of something everyone wants, some willing to kill for, and return the long way around, back to where you started, “there and back again”.

The same story, for the same glory. Leading to the same place.

We keep telling the same tale because it’s “THE” tale to tell.

It ends where you began, only that place, space, and time has shifted.

We come from it, and we return to it.

In-between is what matters.

We could spend a lifetime of starting over.

We set roots in our hearts and memories even if we’re tumbleweed, driftwood, the remnants of old stars in the dark, getting carried along by the tides of reality.

But wherever we are, we can have a place that takes on the same nametag as last.

Home.

I think about that a lot.

It’s not always a fixed location but it is fixed in our minds, hearts, and deep inside.

I sold a property that was once home. It took months, and I was relieved.

It stopped being “home” a long time ago but there was a time when no other place was its equal, that felt safe, and was mine. Years ago, Dad bought it with his mother and sister. And then one day, it was just another place.

My dad passed away over 18 months ago.

After I laid him to rest, there were things to do.

All those things, for the most part, are done, all that remains is looking after mom, and remembering.

The remembering will have the mercy of editing by erosion. The sharp and craggy edges, the parts that draw blood will be softened, dulled, where even the boring is burnished, polished into a glorious patina. Volcanic glass sharper than scalpels is softened into objects d’art, object lessons line the shelves of my understanding of life.

The light of the good pushes on, like ancient stars, and we navigate by them.

I wrote some memories about how I want to remind myself to remember him.

From when he was young. He was pushed out of one home, and went on what looking back became an adventure. At the time, it was survival and school (when possible). The adventure began and ended in one land, then a new life in another.

Not long after the end of these “reminders”, he bought the property that I later sold.

Below is a story of leaving home, making a new one, and then leaving it start another.

These were the Days Dad Started Over.

It wasn't easy was it? Your mother insisted you choose for Australia. You obeyed. Tradition, ritual, and honor.

With just a few pound notes in your pocket, you were stripped of your old life and friends. You were adrift. You managed to keep afloat.

That first week, you saw an old man carrying several bundles to his car, and without thinking, you offered to help him. The man, who had seen so many winters away from home, asked, "Young man, are you a student? Do you need a job?" You got a job.

On a bus, you got up to offer an older lady a seat. This widow, raised in England with servants, was charmed by your manners, and asked you to tea the next day. Your new landlady became a tutor on table manners.

A man with a restaurant and casino offered to introduce you to his daughter, so taken he was with your work ethic. You also picked fruit. A grocer had a standing offer for work if you ever needed it.

Word got around you were reliable and trustworthy. You auctioned chickens. You picked berries. Some days you were hungry.

You learned how to drive with an old car on a farm. Later, you went on a long road-trip with a friend. Once you crashed into a tree, and a giant with a good heart carried you to a hospital. Later on, you bought a sportscar.

Another time, you caught lobster on a fishing boat, and cooked them in a barrel filled with sea water. Later, you were on a passenger ship riding big waves. You and a friend ate like kings while the other passengers were seasick.

Your college buddies absconded with a lamb from some farm on a lark, which you cooked. Your best friend was hopeless as a waiter. You found him work as a dishwasher. Years later he worked on defense projects.

The day came and you had to leave, for Canada. Exhausted after your arrival, you slept 2 days. A long train ride later you arrived to start over.

You only had a few dollars in your pocket in a strange new land, you were stripped of your recent life and friends. A new life. You were adrift, you managed to keep afloat.

You met your wife, and you had new adventures together. And then one day…

You would do it again in America.

I’m writing this, safe in a home that is “home”, like no other place. For now.