Apple's Growth Curves

Hardware then Services, then Hardware...

Apple continues to be understood as a hardware business. Hardware design was at the core of Apple (no pun) since its founding in the 1970s -- but so was its software..

Back when I bought my first Apple computer, I became an “Apple User” and liked the feeling - I belonged. And then one day it was stolen! (OMG, my browser history!) My insurance took care of it but I missed that machine -- and what I had not saved to a backup.

(This pic is not my first Apple computer BUT it is the first computer from Apple, Apple 1, 1976)

Today, as long as I can protect my Apple account and services, losing Apple hardware won’t result in separation anxiety. It’s all about that “Cloud” -- which is really someone else’s computer.

Even if my first “Apple” wasn’t stolen, today I would have upgraded to a “good enough” machine -- good enough to take advantage of Apple software and services.

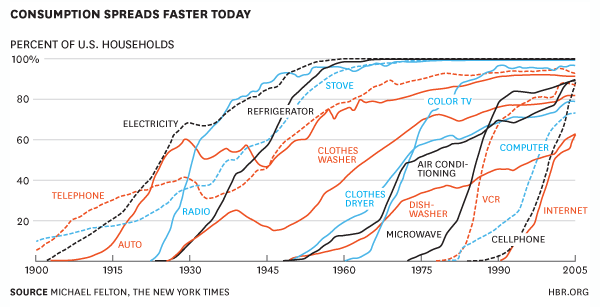

A shift is happening -- and iPhone price-cuts are part of this change. Apple customers aren’t jumping to buy the latest version of iPhone like they used to. The thrill is gone.

Stratechery observed this subtle but real change in Apple’s business from hardware to services:

Apple cut prices.

It was easy to miss, given that the iPhone 11 Pro, the successor to the iPhone X and then Xs, hasn’t changed in price: it still starts at $999 ($1,099 for the larger model), and tops out at $1,449); if you want the best you are going to pay for it.

Perhaps the most interesting aside in the keynote, though, is that for the first time a majority of Apple’s customers weren’t willing to pay for the best.

The real innovation for Apple: hardware is a gateway to services and subscriptions.

The sales trend for iPhones shows a drift from “must have the latest versions” to “good enough” phones that can allow users to access Apple services.

And what kind of services and subscriptions revenue can we expect?

One of those services will include a subscription service for video games -- “Apple Arcade”. It’s going live in 150 countries, giving subscribers access to about 100 games, old and new. Apple pays for the up-front costs of getting games, and over time subscriptions create pure profit.

Another Apple Service with economics similar to Apple Arcade is Apple TV+.

The real comparison to Apple TV+ is Roku -- not Netflix as you might think. Roku sells hardware at cost but makes the money on the programming. For Apple, video content is a customer acquisition cost paid in exchange for the long-term and recurring revenue of a subscription.

A year’s subscription of Apple TV+ comes with the latest Apple hardware. For less than $20 a month, customers can buy an iPhone 11 and also become subscribers of Apple TV+. Other service lines include the AppleCare+ program.

Apple’s latest moves are part of its long history of change. The Apple experience has been neverending dance between hardware and software.

A “Big Stack” piece I wrote recently, “Jony Ive's Long Goodbye” puts it plainly:

Apple’s ability to change is why it is still in business and has become a global tech giant.

When the company nearly died in the late nineties it began its most memorable and transformative moment. Founder Steve Jobs had returned from exile. Upon his return, he scrapped multiple product lines and made peace with its “enemy” at the time -- Microsoft. He would then transform Apple and take it into the future again.

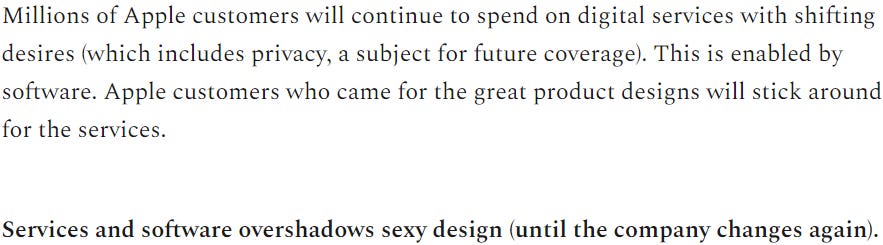

Since its founding Apple has been repeatedly loved, lost, left for dead, rediscovered and loved again. This cycle is perfectly natural. The “S curve” growth model is relevant.

The “S” growth curve helps explain the interplay between software and hardware at Apple.

The first S curve was for Apple’s original product, the Apple 1 and Apple 2 personal computer in the 1970s and 1980s -- in the early days of mainstream demand for PCs. This explosive growth was then extended by new software and hardware upgrades.

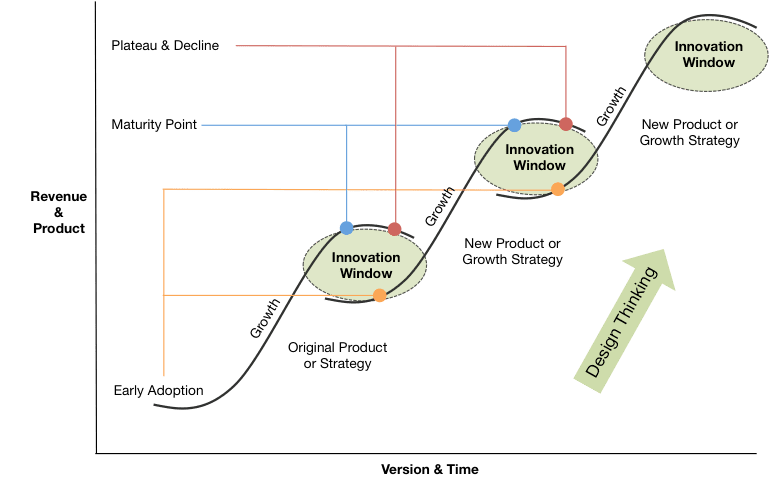

Like the “S” in the chart shared, growth is small at first but then accelerates as more people discover and buy the product. Eventually growth flattens out, after the last adopters jump on board, and growth hits the top of the “S” curve.

And then a new “S” curve hopefully begins, just like a series of new S curves in succession. It’s not as smooth as in the charts shared but this is what is going on each time any company sells a new product or service or finds a new market opportunity with lots of growth potential.

Apple’s next big S curve was when Steve Jobs returned to Apple in the late 1990s -- which was based on sales of new exciting hardware including candy gum drop colored PCs. This hardware also rode the first waves of demand for Internet-based services. Services, including music via Apple’s “iTunes” were sold. This growth was later extended by a whole new hardware line -- small devices with a specific purpose: iPods.

The next S curve, a few years before the 2010s, was due to the merger of three things: attractively designed small form factors (similar in size to iPods), Apple’s PCs and OS, and lastly telecommunications capability. A massive new hardware product was born -- iPhones -- smartphones.

This hardware was a gateway to an ecosystem of software, “apps”, via the” App Store”. The iPhone’s S curve has lasted for a decade. And now most of the world has either an Apple or another maker’s smartphone. This S curve is done.

S curves end eventually because you run out of new buyers and there are no more massive new benefits that can be added in newer versions of the same product to extend that curve.

Time for a new S Curve. And that will involve a dominant business model of software related revenues, which we know about via Software as a Service (SaaS): subscriptions.

The next S curves will be Apple subscriptions BUT also hardware called wearables. (Remember that a dance between hardware and software is still part of Apple’s S curves.)

Apple will still be making new hardware. “Wearables” is a hardware reflecting a long-running, multi-decade trend -- of hardware’s convergence with our bodies. Hardware is moving further from machines on a desk and closer to our bodies -- via high powered bracelets on our wrists or ear-mikes that stay in our ear. But this hardware is merely a vehicle to access subscriptions.

Some closing thoughts on Apple.