The Cloud As "Dune": The Rise of House Snowflake

On The Cloud, Data is life.

IPO Spring has arrived thanks to a Snowflake - a platform floating on the constant and massive growth of the world’s data - along with change for the Cloud economy.

Snowflake’s IPO, anticipated for years, had a blockbuster record IPO. Denis Villeneuve’s film adaptation of Frank Herbert’s sci-fi cult classic Dune, has also been eagerly anticipated. The book’s plot came to mind as I began to read about Snowflake.

If you know “Dune”, then you can understand Snowflake the same way I do:

Imagine that Snowflake is House Atriedes, ready to take over data analytics space.

Data is the raw spice melange, a raw material gathered and refined into an empowering product.

On Arrakis, water is life but first you have to control the spice.

On the Cloud, sales is life but first you have to control the data.

Maybe you’re not a fan of Dune yet? I will share a simplified description of the book.

In the distant future, thousands of years from now, mankind is an imperial galactic civilization capable of godlike mental, psychic and physical feats, including space travel, but humanity remains the same. There’s still greed, hate, fear, envy, and love.

The great resource driving this empire is the spice “Melange”. Melange enhances humans - it fuels the economic power of the Emperor and the Landsraad, the empire’s ruling families. Other players include special groups of enhanced humans, including human computers (the Mentats), mutated humans who enable spacetravel (the Space Guild), and a powerful sisterhood (the Bene Gesserit) who are plugged in politically.

One family, the Atriedes, is set to take control of the only source for melange, the desert planet Arrakis. They leave a lush water homeworld to go to a desert planet but the rewards are great. The future looks limitless for House Atriedes.

It’s a trap however - laid by the Emperor, threatened by the Atriedes as a potential rival, and the Harkonnens, long time enemies and the former overlords of Arrakis’ spice mines.

Soon after taking up residence on their new desert kingdom, the Atriedes are betrayed, their base and fortress are sabotaged. Duke Leto Atriedes is kidnapped and set up to kill Baron Vladimir Harkonnen but fails and dies. His widow Jessica and son Paul flee.

All seems lost but young Paul Atriedes, heir to Duke Leto, is different. He is transformed by the spice, and his mother by a dangerous elixir, thanks to their new allies, the Fremen (the residents and true masters of Arrakis). The Fremen have bided their time and accumulated what is a treasure on a desert planet - massive reservoirs of water. The Fremen are also masters of the secret source of melange - the sandworms of Arrakis. Only the Fremen know how to harness these fearsome desert leviathans.

Empowered by the spice, Paul can see the future and with the help of the Fremen, goes to war and takes back his birthright. House Harkonnen and other rival families including their sponsor and ally, the Emperor, are out. The galactic order has been turned upside down. Paul Atriedes begins a new galactic empire.

With our Dune synopsis in mind, let’s bring Snowflake into the picture.

Remember what I said:

Imagine that Snowflake is House Atriedes, ready to take over data analytics space.

Data is the raw spice melange, a raw material gathered and refined into empowering products.

Time for a deep dive into Snowflake (please keep in mind my Dune synopsis):

Petabytes of raw mostly unstructured data are waiting to be gathered, stored, and processed, a/k/a undergo extraction, loading and transformation (“ELT”)*, in effect refined into a resource that could transform a business into a more competitive and profitable entity.

Snowflake is plugged into multiple cloud platforms - as the “spice refinery” transforming the raw spice of data (unstructured or formatted) into data analysis, insight and services.

(*“ELT” as preferred by Snowflake, a flip of the “ETL” model in data analysis.)

Imagine that the Cloud Giants, Amazon, Google, Microsoft, etc., are the Emperor and the ruling families of Dune’s Landsraad. In Dune, the powers that be are constantly wrestling for control of Arrakis and therefore the galaxy. The Cloud Giants are competing for greater shares of the ever-growing and evolving “Cloud”. The ultimate prizes in Dune include the spice, power and water. In the Cloud economy, the ultimate rewards are the data, platforms and sales.

On Arrakis, water is life but first you have to control the spice.

On the Cloud, sales is life but first you have to control the data.

If Snowflake is the new upstart, like House Atriedes, I wondered if would they survive long enough and become a Cloud giant.

Will Snowflake one day struggle to survive just like Paul Atriedes? Will House Amazon or the other Cloud houses crush both Snowflake’s tech and business model?

Let’s revisit the details of Snowflake.

”Snowflake was started in the summer of 2012 by French co-founders Thierry Cruanes and Benoit Dageville, two long-time Oracle engineers and colleagues. They were joined shortly thereafter by database performance expert Marcin Zukowski.

The co-founders chose Snowflake as the company's name because of their love for ski sports and because "Snowflakes are born in the cloud" and Snowflake built a cloud data warehouse from the ground up for the cloud.”

If you’re making and managing lots of data, which you want to analyze, you would love to have more efficient and easier to use “compute and store”, i.e. crunching and caching. It requires money, hardware, and time to analyze data that keeps on growing.

What if the cost, time and effort of maintaining hardware and updates were removed and all business customers had to do was open a secure interface to deposit, access and analyze all of their data (pouring in 24/7 from different sources and formats)?

An 2014 memo of a test, via early investor Redpoint, hinted at Snowflake’s potential:

Took one month of ad platform data and did an A/B test against AWS Redshift. Redshift took an entire day to load compared to Snowflake’s alpha product at 12 minutes.

Every successful platform started as a solution for a specific problem - Snowflake solves for large scale “data warehouse” analytics - where the focus is on consuming and storing a never-ending feast of data, much of it effectively unstructured, and making it easier to find needles of insight from endless fields of data haystacks.

The problem was “traditional on-premise data warehouses …were rigid and difficult to use and limited in computation & storage because data warehouses were constrained by the amount of hardware and physical server space companies had...”

Snowflake’s solution is “data warehousing designed and built for cloud environments that were faster than traditional data warehouses and could ride on top of the scalability of the cloud – companies could store and process as much data as they needed on demand by relying on cloud vendors like Amazon….”

The history of the web hosting business is a precedent for Snowflake’s future.

There was a time when everyone had to own servers, software and connections and managed their websites on their own. Then they moved to hosting companies, which handled took custody and connected customers’ machines to the internet. Later customers rented the hardware which would be managed by the hosting companies. That model evolved to virtual servers - servers made of software were packed into fewer machines. Software ate web hosting.

Data warehouses incumbents were confined by hardware limits - but not Snowflake.

The virtualization and evolution of Data warehouses is the hosting arc magnified.

The big picture: a virtual layer captures more of the economic value of direct, near-term and near-by customer relationships. The physical stacks are pushed further and deeper away from the end users, the business customers, and become commodities.

Snowflake’s Software will eat on-premise data warehouses and physical infrastructure.

How?

Snowflake’s storage layer is built on the Cloud. Its data warehouse uses public cloud providers to create separate environments, data microclimates designed with separations between “compute” from “store” functions, and operating on top of the location and time zones of the Cloud giants. It will create clouds within clouds.

Snowflake’s cloud architecture has consequences for the Cloud giants. The use of AWS, Azure and Google Cloud are line item expenses for Snowflake. The customer experience is through a new front-end - Snowflake’s. The incumbent Cloud providers’ fate, through the lens of “S” curve growth arcs, ends in commodification.

What is it about Snowflake that makes it a potential gamechanger for data services?

Snowflake is going to be a layer that many customers use as their Cloud experience. The first cohorts of users are Data Analysts but when the walls of data silos fall, then many kinds of end-users inside business customers will have similar experiences.

Its software has easier interfaces, integrations and instructions, enabling third party software for gathering and dumping mountains of data (things like Tableau install easily), and runs faster than incumbent competitors. This ease of use however is also safe, with security maintained at the service layer (with high level certifications).

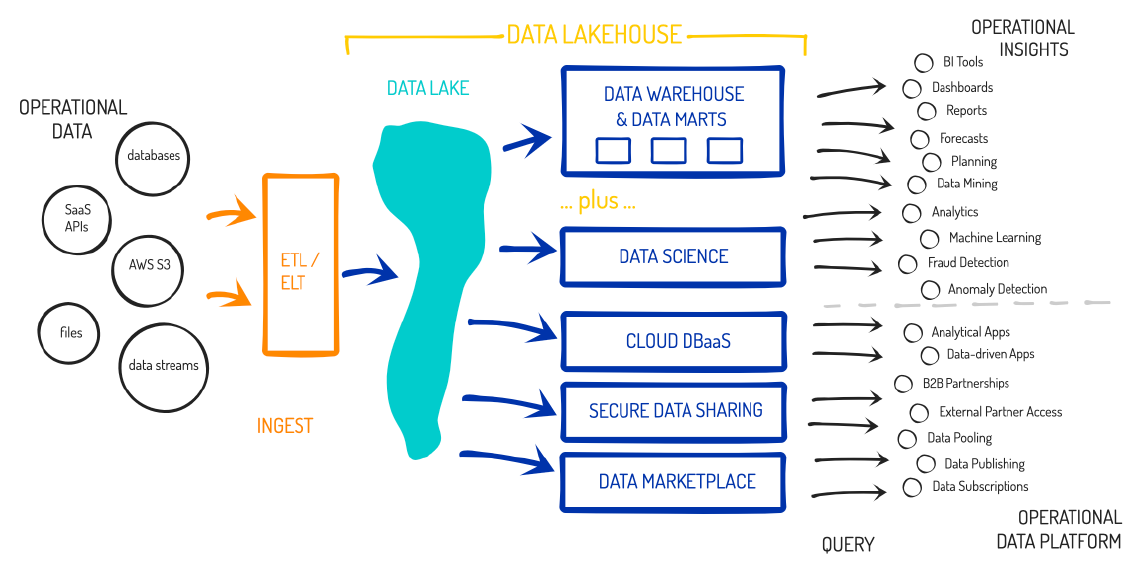

This graphic from HHHypergrowth is the best visualization of what Snowflake does.

Extracting from operational data, the raw data, is dumped into a vast reservoir, analysts can just use SQL in a “Data Lakehouse” to quickly analyze for insights.

Snowflake’s accessibility with SQL reflects a deliberately designed ease of use and customer friendliness. Knowing one flavor of SQL is like knowing one Romance language really well - if you know Latin or Italian then Spanish comes easily.

A podcast with CEO Frank Slootman on the past, present and future of the data cloud describes the ambition of what’s ahead for Snowflake. Slootman was recruited out of retirement to run SnowFlake- during his time as CEO of ServiceNow (from 2011 to 2017) revenue grew from 75M to 1.5B.

So far Snowflake’s numbers have been equally stunning.

SNOW was valued at 12+B in its last VC round before becoming a 70+B public company. (Witty Wealth estimated that SNOW could become a “10-bagger”.)

It was the 2nd fastest growing SaaS Company to IPO and 3d fastest growing Public SaaS company “with ~$532m annualized run-rate revenue (ARRR) growing 121%” (according to Public Comps). But it’s not profitable yet. It must get market share.

The market opportunity, a/k/a Total Addressable Market (TAM) for now is about 135 to 140B, made up of about 80+B for cloud data and about 50 to 60B for analytics.

Data stored in the public cloud will soar from 30% to about 50% by 2025 (according to IDC) - in many formats from many sources - “unstructured” and abundant. Businesses store a 24/7 blizzard of data for archives and analytics in data warehouses.

One of the most interesting quirks is that SNOW does not have a founder-cult CEO at the helm. None of Snowflake‘s founders are CEO - they began with someone from their first investor, Sutter Hill Ventures, then a Microsoft veteran, and now Slootman.

Byrne Hobart noted in his "Snowflake and the Price of Simplicity”, that SNOW had “an S-1 many other people have been looking forward to. Snowflake has staggeringly good unit economics, and sells a unique service—they make “big data” work the way you’d imagine it worked if you didn’t spend much time actually compiling and analyzing large datasets”.

The customer is the focus: Pricing is usage-based and not the number-of-users SaaS model. This customer friendly pricing included on demand and prepaid discount pricing. This has led to the 2nd highest net dollar retention among all Public SaaS (after #1 leader Agora (API) which also has usage-based pricing).

Anything which makes things work in a way customers wished it would - with less stress and cost - could change industry practices and become the new standard.

Throw in positive unit economics and eventual mass adoption, then an investment, by someone with authority and autonomy, as a long-term “partner” should be natural. Todd Combs was that someone with authority and autonomy to invest $500+M, and Berkshire Hathaway owning nearly 20% of Snowflake’s Class A shares through a private placement and buyout of a Snowflake’s former CEO’s shares.

What can an investor with a long-term time frame expect? It’s called the “Data Cloud”.

Snowflake’s Data Cloud already has a lot of customers.

With 3100+ customers and 50+ of them in the $1M circle, Snowflake’s top 2% customer have contributed to about 20% of the latest annual revenue, and reads like an honor roll of some of the world’s top enterprise customers. At the moment, 146 of Fortune 500 provides 26% of Snowflake’s top line.

All customers will have access to Snowflake’s emerging ecosystem of integration partners and Snowflake describes these integrations as part of “the Data Cloud, an ecosystem where Snowflake customers, partners, and data providers can break down data silos and derive value from rapidly growing data sets in secure, governed, and compliant ways.”

Tied to Snowflake’s revenue success is a risk however - it’s a fast growing cloud business market where cloud providers (e.g AWS Redshift) have competitive solutions, and Snowflake is built on AWS, GCP, and Azure’s cloud environments.

Snowflake’s success is an invitation to the Cloud Giants to turn an S-1 risk into reality.

”We currently only offer our platform on the public clouds provided by AWS, Azure, and GCP, which are also some of our primary competitors. Currently, a substantial majority of our business is run on the AWS public cloud. There is risk that one or more of these public cloud providers could use their respective control of their public clouds”.

Slowflake is not only competing with Data Warehouses, it’s also a competitor of the same Cloud giants which also solve the same problems with competing solutions.

Snowflake virtualization software will “eat” physical data warehouses, and it will also commodify Cloud Giant analytic services. Snowflake’s analytics services may catch up to the Cloud Giants. I wonder if there’s trouble or a consolidation ahead.

Amazon Redshift: 13,060 up 5% YoY

Google Big Query: 8,272 up 35% YoY

Azure Synapse: 6,032 up 25% YoY

Snowflake (S-1): 3,117 up 101% YoY

(Stats courtesy of HG Data via. Public Comps.)

Snowflake is liked not only for its ease of use, its billing reflects that same sensibility.

Billing is friendlier and less costly than user and calendar based contracts - Snowflake charges separately for compute, storage and cloud services.

Net Dollar Retention makes me think that a growth loop of going from niche strength to next niche strength, could turn Snowflake into the go to insight services platform.

Net Dollar Retention is that percent of revenue from current customers kept, retained, from the prior year, after including changes for upgrades, downgrades, and churn.

The higher the net dollar retention, the better. When you have customer turnover, losses of customers from the prior period, like the year before, then you have to keep starting over and getting more new sales to new customers. For a one off sales business that might be natural but if you’re claiming to be a recurring revenue cloud business then losing last year’s customers is very bad news.

Snowflake’s net dollar retention math = (the beginning of period revenue + upgrades - downgrades - churn), divided by, (the beginning of period revenue)

If Snowflake’s net dollar retention is greater than 100%

then growth from its existing customer base

is greater than losses from that customer base.

If net dollar retention was less than 100%

the turnover, customer churn, and downgrades

is greater than the gains from those same customers.

Snowflake’s most recent net dollar retention is 158%.

That’s a whole lot of up-selling and good customer service at work - Snowflake’s sales costs are about 70% of revenue and that pays for a lot of service. (To be fair, Net Dollar Retention is likely to drop over time - the year before, it was 200+% - it’s early days.) What’s the industry comparison like? According to Public Comps, the SaaS IPO average (a/k/a 50% percentile) is 119%, the top 10% (a/k/a 90% percentile) is 140%.

Another interesting feature at the service layer is not only security but also sharing. Customers can use Snowflake to securely share querying privileges with those who aren’t Snowflake customers. This insights exchange will draw and lock in users tighter.

Not only that, users can work with every cloud instance they made - they’re no longer tied to just one Cloud platform’s setup to organize and analyze their data. All of it.

Auren Hoffman said, “Great DaaS [a/k/a “Data as a Service”] companies act like compute companies (think AWS) — they lower dollar per datum prices every month. So customers get more value for the money and that value compounds over time.” As people learn about Snowflake’s data exchange and product potential they will like it.

What is the secular trend of what we know as the “Cloud”? A constantly growing field of unstructured data - mountains of data. It has to be stored, managed and used. Much of it stored on Cloud platforms but it has to be harvested and refined into insights.

An easy to use unstructured data analytics layer is growing on top of the current Cloud.

It’s a layer that’s user comfortable, with a customer friendly UX and pricing design, that’s standing in between the world’s data creators, the customers, and the world’s data holders, the Cloud giants. Snowflake could become the face of the Cloud for users.

The drivers for a feedback loop - a flywheel for Snowflake’s growth - are in place.

This flywheel could be how Snowflake joins the leadership of the Cloud.

The flywheel begins with:

“storage as a service” (it’s Cloud Giant agnostic, so whether it’s AWS, Azure,Google, etc., it doesn’t matter, they’re commodities), as the datalake swallows more data

then it’s “compute as a service”, scalable crunching of data stored on the “lake”,

which becomes “data products as a service” (thanks to the potential products from its exchange), since the crunching created valuable analytical content on demand,

Lastly all of these layers, and especially the exchange marketplace, invites developers who can build out and grow the Snowflake ecosystem. Life on the “Datalake” is good.

Each layer feeds the next, and it grows organically with the cloud and creates new kinds of data from analysis and the exchange, to be fed right back into its ecosystem.

It’s all cloud native and endlessly scalable, up and down per user needs, but in aggregate it’s constantly floating upward with “the Cloud” as it grows ever larger.

This is how House Snowflake turns things upside down and rises on the Cloud.

___________________________________________________________________________

A brief reading and source list

Dune wiki page

The S-1 registration

Data Storage: Transactions vs. Analytics, a podcast

The past, present and future of data storage, Frank Slootman podcast

A Snowflake Deep Dive (by HHHypergrowth, a great piece)

Data Warehouse with Christian Kleinerman, VP Product, Snowflake podcast

Data as a Service Bible by Auren Hoffman

Internet Trends 2019, Mary Meeker (Bond)

Snowflake S-1 & IPO Teardown by Public Comp’s Jon Ma

What’s a Good Level of Net Dollar Retention (Crunchbase)

Spectacular Snowflake by Witty Wealth guest writer Annika Lewis

Why Redpoint Invested in Snowflake in Early 2014 by Satish Dharmaraj

Unexpected cross-over of topics! I like

Very well written article!

Can you provide a source to the statement of the investor redpoint? Couldn't find anything to this. Thank you :)

EDIT: Found the source - for everybody interested: https://medium.com/redpoint-ventures/why-redpoint-invested-in-snowflake-in-early-2014-6c11ed92452e